HM Treasury

|

|

New tax year: changes coming into effect in 2015

New tax changes come into effect at the start of each financial year. Here’s a list of things coming into effect in April 2015 to back businesses and support people.

1.

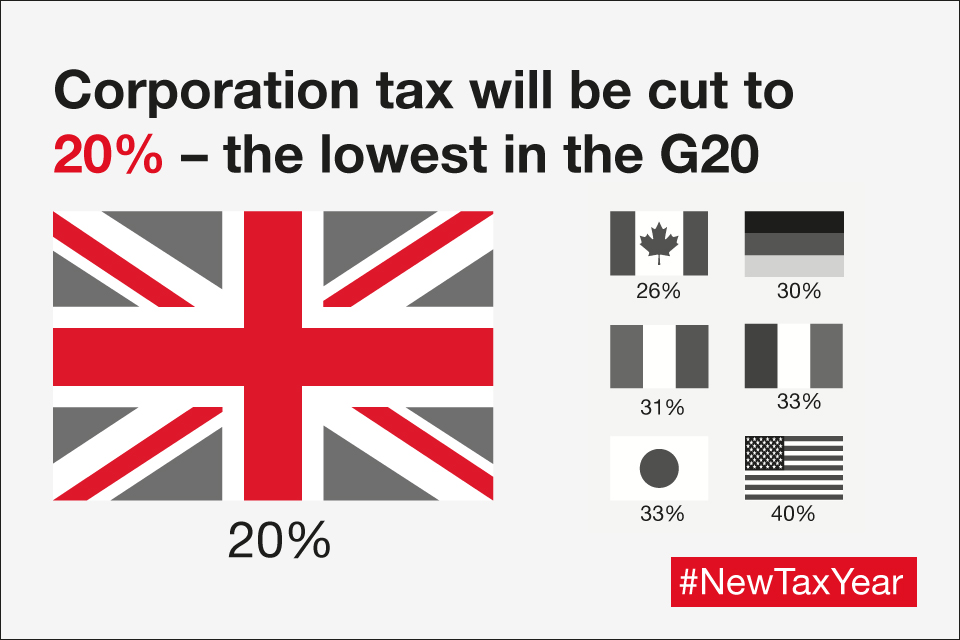

From April 1, the corporation tax that businesses pay will be cut to 20%, the lowest rate in the G20. Currently, it is 21%. In 2010, it was 28%.

Corporation tax will be cut to 20% – the lowest in the G20

2.

The government is increasing business rates support for the high street by raising the £1,000 retail discount to £1,500 for shops, pubs, cafes and restaurants with a rateable value of £50,000 and below on April 1.

From April 1, we’re increasing business rates help for the high street.

3.

A new tax relief for children’s TV production begins on April 1 to support Britain’s thriving creative industries.

A new 25% tax relief for children’s TV production begins April 1.

4.

The government is creating a fairer tax system by introducing the Diverted Profits Tax on April 1. This clamps down on multinational companies artificially shifting their profits offshore to avoid paying tax in the UK.

On April 1 we’re introducing the Diverted Profits tax.

5.

From 6 April, employers hiring under 21s will be no longer face National Insurance Contributions (NICs) tax bills.

No employer National Insurance contributions (NICs) for under 21s.

6.

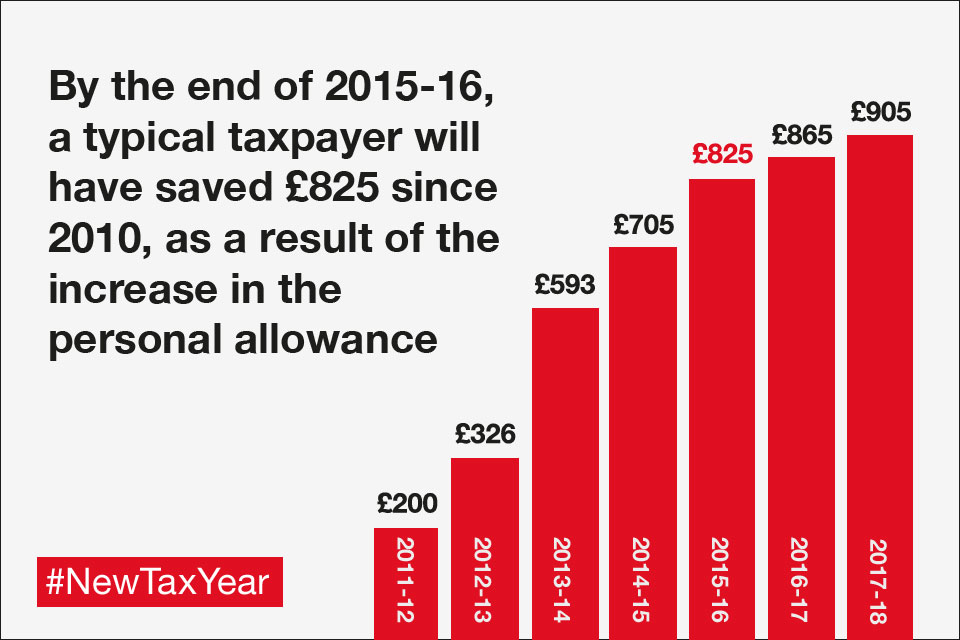

People on lower incomes will pay no income tax at all, as personal allowance rises from £10,000 to £10,600 on April 6. In 2015-16, a typical taxpayer will save £825 as a result of the increase in the tax-free personal allowance – the amount that people earn before they start paying tax.

By the end of 2015-16, a typical taxpayer will have saved £825 since 2010, as a result of the increase in the personal allowance.

7.

The starting rate of savings tax will be cut from 10% to 0% for savings up to £5000 – taking 1.5 million people out of paying tax on their savings income from April 6

We’re cutting tax on savings interest for those with an income less than £15,600 a year.

8.

People hiring care and support workers will be able to claim up to £2,000 off their employer National Insurance contributions (NICs) bill from April 6.

Claim up to £2,000 off your National Insurance contributions (NICs) bill from April 6, when hiring a care and support worker.

9.

Over 4 million married couples and 15,000 civil partnerships will be eligible for a tax break from April 6 as the government introduces measures to allow eligible couples to transfer up to £1,060 of their personal tax free allowance to their partner – as long as both don’t pay more than the basic rate of income tax.

Eligible couples will be able to transfer up to £1,060 of their personal allowance to their partner.

10.

The most ground-breaking pension reforms in nearly a hundred years come into force on April 6. People will no longer be obliged to buy an annuity and be able to access their defined contribution pension flexibly. The law will also change so that if an individual dies before the age of 75, they will be able to pass on their pension pot tax free.

The most ground-breaking pension reforms in nearly a hundred years come into force.

11.

And later this year, from May 1, families won’t have to pay Air Passenger Duty on economy flights for children under 12.

From May 1, families won’t have to pay Air Passenger Duty on Economy flights for children under 12.

.png)