RUSI

|

|

The Haves and Have Nots of Sanctions Implementation

Sanctions against Russia have captured the world’s attention, but the global community must not neglect other regimes as a result.

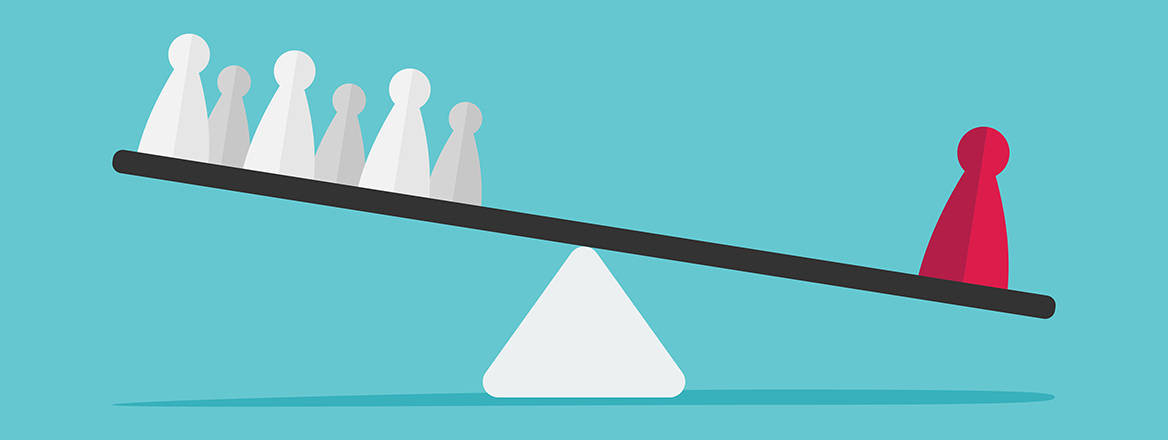

While sanctions against Russia remain the primary focus of the international community, a new UN report shows that international implementation of sanctions against North Korea continues to be patchy. This is not so much down to a lack of political will, but rather a growing divide between the ‘haves’ and ‘have nots’ on the front line of implementation.

Last week, the UN Security Council released the Panel of Experts’ midterm report on the implementation of international sanctions against North Korea. As with past reports, the Panel found that North Korea continues to generate revenue and access the international financial system in contravention of international sanctions – highlighting the apparent continued failures of member states to fully implement their international obligations. While some countries, like Russia, intentionally fail to uphold their international obligations – instead seeking to purchase conventional weapons from North Korea in violation of the arms embargo – others face a more practical problem: the lack of adequate resources.

Effective implementation of international sanctions requires equal participation by states, their institutions and their industries. While state-sponsored capacity building and outreach efforts have raised awareness of implementation requirements, smaller institutions – especially those in the developing world – lack access to information, tools and other resources that would promote more effective implementation. This ‘capability’ dimension of countering proliferation financing and sanctions implementation is largely ignored.

Most states have the capacity to implement sanctions – including awareness of requirements and relevant legal and regulatory controls. But capability to do so remains limited, especially in low-income countries. Access to quality data and tools can vary significantly by region and size of financial institution. In fact, according to a survey of financial institutions’ attitudes towards proliferation financing by RUSI, only 20% of respondents said that governments provide enough information.

A 2020 report by LexisNexis projected that globally, banks’ costs associated with combating financial crime amounted to nearly $214 billion, up from $180.9 billion the previous year. But not all banks share these costs equally. Investments in technology-based compliance and know-your-customer solutions have lowered costs for Western banks, while banks in developing countries have seen increases in associated costs.

Low-income Countries Lag Significantly Behind

In April 2022, the Financial Action Task Force (FATF) – the international organisation responsible for setting anti-money laundering standards – released a report on the state of global efforts to tackle money laundering, terrorist financing and proliferation financing. The report – a first of its kind by the FATF – found that overall, countries had made progress, ‘improving technical compliance by establishing and enacting a broad range of laws and regulations’, further highlighting that 76% of countries had implemented its recommendations to a satisfactory level.

The mutual evaluation data shows stark differences between rich and poor countries when it comes to implementing proliferation financing-related requirements

While these findings are encouraging, they paint a far more optimistic picture of the state of countering proliferation financing and sanctions implementation than what reality reveals. The fact is that the mutual evaluation data shows stark differences between rich and poor countries when it comes to implementing proliferation financing-related requirements, further highlighting gaps that countries like North Korea can exploit.

FATF recommendation seven requires countries to implement the targeted financial sanctions found in relevant UN sanctions regimes. Whereas nearly 70% of high-income countries were found to be ‘compliant’ or ‘largely compliant’, the same was true for only 10% of low-income countries.

One issue is that in recent years, it is not just the banks that are feeling the pressure to implement international and autonomous sanctions regimes. Designated Non-Financial Businesses and Professions (DNFBPs) – like accountants, lawyers, dealers in precious stones, real estate agents and company formation agents – are also under increasing pressure to guard their industries from sanctions-evaders, often with not only limited guidance but also restricted access to data and information. A 2022 RUSI report by Sasha Erskine noted that many of the FATF standards do not fully consider the range of sanctions-evasion efforts that North Korea employs, especially against DNFBPs.

Similarly, many of North Korea’s revenue-generating activities are increasingly taking place in the virtual world, a realm that is far beyond the ability of many countries to operate in.

What Needs to be Done?

Improving data standards, promoting information exchange and forging public-private partnerships will go a long way. So too will technical assistance and outreach activities. These programmes, however, are in high demand and short supply, and will require greater investment on the part of the West to close proliferation financing and sanctions implementation gaps.

Suggesting that states promote ‘better information sharing relationships between public and private sectors’, however, has become an almost comedic mantra – often repeated, but rarely understood or followed. In some cases, sharing information may not be feasible due to security concerns; in others there may be legitimate legal or regulatory challenges. For instance, information sharing among manufacturers in the US could run afoul of antitrust legislation. In other cases, the political will to do so may just not be present.

Ensuring that the ‘have nots’ have a minimum level of access to data and tools will go a long way towards shoring up the gaps that countries like North Korea are so adept at exploiting

To more effectively address proliferation financing and promote better sanctions implementation, international organisations will need to address these growing gaps between capacity and capability in low-income countries.

First, the FATF should begin to promote data standards on targeted financial sanctions. At a minimum, this should include best practices when it comes to collection, presentation and access to designated entities. Currently, most sanctions-related data is diffuse and siloed – some is only accessible to those with the means to access it. Published designated entity lists, which are those lists that contain pertinent information about sanctioned individuals, companies and vessels, are often incomplete or difficult to integrate into IT systems.

Second, open-source tools and investigative techniques should be part of technical assistance and training curriculums related to countering proliferation financing and sanctions implementation. These tools should also be included in a central repository that is easily accessible to both states and private sector entities.

Finally, the time has come for states to begin tackling problems with information sharing. Excuses related to information security are quickly becoming anachronistic. Zero-knowledge protocols, for example, are a potentially useful technological solution, allowing one party to prove to another that a given piece of information is true, while avoiding the need to disclose additional information. The premise of these developing technologies could prove beneficial in closing such information gaps.

Ultimately, effective sanctions implementation starts at the frontline – the banks and DNFBPs responsible for conducting due diligence and know-your-customer functions. Ensuring that the ‘have nots’ have a minimum level of access to data and tools will go a long way towards shoring up the gaps that countries like North Korea are so adept at exploiting.

The views expressed in this Commentary are the author’s, and do not represent those of RUSI or any other institution.

Have an idea for a Commentary you’d like to write for us? Send a short pitch to commentaries@rusi.org and we’ll get back to you if it fits into our research interests. Full guidelines for contributors can be found here.

Original article link: https://rusi.org/explore-our-research/publications/commentary/haves-and-have-nots-sanctions-implementation