FSCS embraces artificial intelligence to help customers

7 Jan 2021 11:12 AM

FSCS is pioneering the use of artificial intelligence (AI) to help process claims – it's the latest innovation we've brought in to improve the experience for our customers. But what is AI, how accurate is it and why are we using it?

What is AI?

AI is the process of developing machines to have intellectual, human characteristics, such as the ability to reason, discover meaning and learn from past experience. AI is often used to solve problems, make decisions and speed up processes.

AI isn’t new technology – it’s been around for years – but FSCS has only now considered it advanced and accurate enough to produce the consistently credible results we need when helping us process claims.

How and why did FSCS start to use AI?

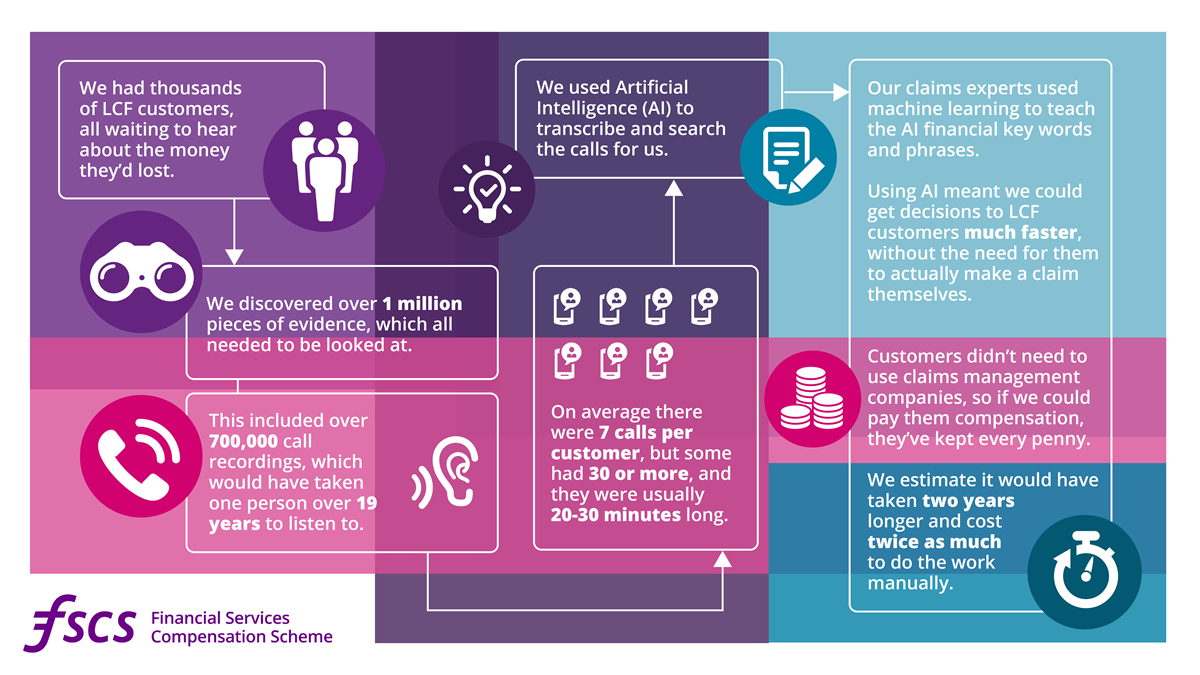

We decided to use AI to help us in our decision making in the London Capital & Finance plc (LCF) case due to the sheer volume of evidence and the vast number of claims we needed to process. We knew that LCF’s customers had already been through enough and we were committed to making decisions on their claims as quickly as possible and minimising the amount of work they needed to do.

The LCF case was a natural fit for using AI because we had sourced vast amounts of customer information which we needed to review as part of our extensive investigations to help us decide on each claim. This amounted to over 1 million pieces of evidence, including 700,000 call recordings that needed to be analysed. Emails and letters aren't a problem, as we can search these with basic technology. However, it would have been incredibly time-consuming and expensive to listen to so many phone calls manually while LCF's customers awaited the outcome of their claims. We estimated that a team of 10 would need around two years of full-time work to listen to every call from start to finish, and only then could we actually start to review claims.

We worked with our partners Capita, Capgemini and Microsoft to create a solution: to use voice-detect technology to analyse the phone recordings. We had a list of specific keywords and phrases we were looking for in the phone calls which, together with the information we had gathered and analysed, would show whether customers of LCF had claims for compensation.

AI translated audio from the phone calls into text, allowing our claims handlers to search the text for the relevant keywords and phrases, rather than having to listen to each entire phone call. The automation went one step further and told our claims handlers at what point in the call recording the specific keyword or phrase was used, saving even more time. The claims handlers could then double-check the accuracy of each result as another layer of precision.

How FSCS used AI to help process LCF claims

We started paying LCF advice claims in June 2020. We estimate that without using AI, we wouldn’t have been able to start paying compensation to these customers until 2021, and wouldn't complete the work until beyond 2022.

As well as the customer benefits, using AI has enabled us to halve the cost of processing LCF claims. This reduction in costs represents a significant saving in our management expenses, as part of our ongoing commitment to keep our costs as low as possible, and our efforts to reduce levy bills.

Gathering all the data and evidence ourselves and using AI to analyse it has also saved our LCF customers time and effort as they haven't needed to make a claim themselves. Not needing to make a claim also meant customers didn't need to consider using a claims management company (CMC) to help them. This means that when we've finished paying out LCF compensation, around £18m more will be in our customers' pockets, rather than with CMCs.

How accurate is AI?

As is often the case when adopting a new approach, there was an element of trial and error when we began to use AI, as we learned how to get the best out of the technology. We identified that some of the early results the AI produced weren’t as accurate as we needed them to be. To solve this, our claims experts applied machine learning (a specific branch of AI that trains a machine how to learn), which vastly improved the quality of the results. We taught the system the financial terminology it needed to accurately analyse the calls and corrected any mistakes it initially made. For example, to begin with, the system confused 'risky' with 'whisky', so we taught it to tell the difference and not make the same mistakes again. We ensured our experts manually checked the accuracy of the AI before we made any claims decisions.

Now our experts are satisfied that AI is producing the right outcomes and helping us to provide quick and accurate outcomes on claims.

What’s the future for AI and FSCS?

We see AI playing an integral part in the future of claims handling, especially when there are high volumes of claims to process. Following LCF, we have also used AI to help in our investigations of two other firms that have gone out of business which has again vastly speeded up the claims process. We're also looking at using this approach for future self-invested personal pension (SIPP) operator failures to speed up the process and reduce the effort our customers must put in to get their money back.

Jimmy Barber, FSCS Chief Operating Officer, said:

“We are constantly reviewing the accuracy of the AI results and we continue to apply machine learning to make sure we always get accurate results from the technology. As a result of its use, we have been able to ensure that our customers get their claims decisions as quickly as possible. The cost of processing claims is also significantly cheaper. We are looking at how we can leverage this technology more in the future.”