Trip to Edinburgh gives some useful pointers for future FSCS work

9 Mar 2023 12:48 PM

In our latest blog Chief Communications Officer, Lila Pleban reflects on a recent FSCS visit to Scotland.

By FSCS Team

Published: 09 March 2023 FSCS news

As a national organisation, FSCS recognises the importance of engaging with its stakeholders and levy payers across the United Kingdom. This means being alive to the challenges and potential harm being faced by all consumers, no matter where they live. That is why we are working to identify trends and help tackle pockets of harm, to support regional and devolved decision-making.

The financial services industry is pivotal to local economies across the UK, with two thirds of the 2.2m financial services roles based outside London [1]. For example, Scotland is the seventh leading financial centre in Europe [2] and the second largest international financial hub in the UK. The Scottish financial services industry employs 145,000 people and contributes £11bn to the UK economy – 7% of the UK total.[3] Edinburgh and Glasgow are the major centres, accounting for 48,325 and 38,200 of the employees in the industry, respectively.

Whilst FSCS exists to pay claims and build confidence for consumers in financial services, it is the data and stories we collect, when we become a ‘last hope’ for many where we glean the real insights into harm in the system.

As we drill down into our data, looking at different demographics and communities, we have been able to better target our awareness campaigns. In the last year we launched a new TV and radio advertising campaign designed to increase public awareness and understanding of the protection FSCS can offer when pension advisers and providers fail. The adverts specifically targeted people in the Northwest, West Midlands, and the Northeast of England because our data shows that individuals within these areas are more likely to come to FSCS with a claim than any other regions in the UK.

We were also able to look more closely at the regional impacts, and this is when we decided to head to Edinburgh towards the end of 2022, armed with our latest insights. We wanted an opportunity to share our findings with the Scottish financial services industry and political stakeholders and better connect with them. We also wanted to build our understanding of Scottish consumers and the financial services landscape.

It was fantastic to receive such a warm welcome in every meeting we had. The various political and industry stakeholders we met were all keen to explore how FSCS insights can support their work and understanding about the key role that FSCS plays in supporting Scottish consumers. They were also interested to hear about our work to educate and inform consumers about FSCS protection in Scotland and our work with political, regulatory and industry institutions across the UK.

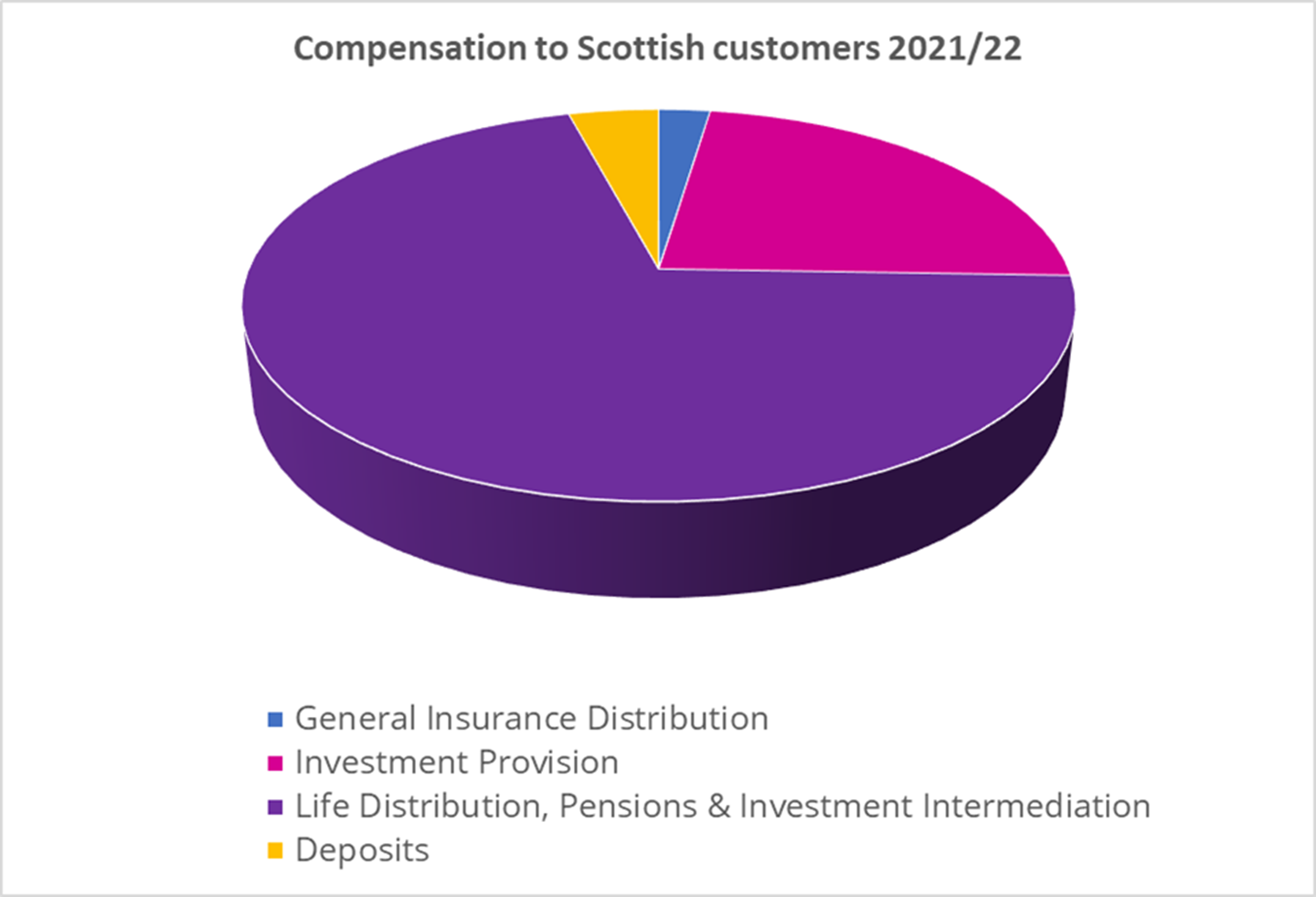

In 2021/22 we helped over 108,000 UK customers get back on track when financial firms failed, paying out £584m in compensation. Of this total, we paid 5,200 Scottish customers £48 million in compensation.[4] The graph below shows the breakdown of compensation in different areas.

When it comes to the support FSCS has provided to Scottish customers from 2016 up until October 2022[5]:

- FSCS has had 34,261 claims from Scottish customers, paying them £208 million in compensation.

- 14,967 of these claims were linked to financial advice (& investments), accounting for £193.5m in compensation, while 19,294 claims were linked to deposits, making up £14.5m in compensation.

Although FSCS has received more deposit claims than advice claims, as the graph above shows, the average amount of compensation paid per customer is small (£751)[1] compared to the average amount paid out for claims related to financial advice (£12,928). This highlights the levels of consumer harm we often see in the advice market, both in Scotland and the UK as a whole, particularly when it comes to advice related to pensions, which has accounted for around three quarters of our financial advice claims in recent years. We expect these costs to remain high for a number of years as 80% of our customers come to us at least five years after they received poor advice.

The deposits figures shown in the graph above relate to the failures of seven Scottish credit unions since 2016. Credit unions are member-owned non-profit financial organisations which offer practical low-cost services to local communities. They often offer a financial lifeline to those with poor credit ratings and no access to a bank account. We know that credit unions can play a vital role for vulnerable customers.

Our visit to Edinburgh is just the latest example of how we can use our data and insights to open up a dialogue with regional stakeholders and help us better target our activity and support regional decision-making, as we continue to build understanding and awareness of FSCS across the UK. We will continue to build up our links with stakeholders in Scotland and explore the new opportunities that have opened up for us following our visit.

RFC March 2023

[1] https://www.thecityuk.com/news/subnational-economies-and-the-role-of-financial-and-related-professional-services/

[2] https://scottishcities.org.uk/edinburgh/

[3] House of Commons Library: Financial Services: Contribution to the UK Economy, September 2022 https://researchbriefings.files.parliament.uk/documents/SN06193/SN06193.pdf p10

[4] FSCS internal figures November 2022

[5] But please note, these figures do not include insurance as we are unable to analyse insurance claims by geography

[6] FSCS internal figures October 2022 – average cost of claims 2016 to date